tax strategies for high-income earners 2020

The main reason is that youre able to recover the cost of income-producing property through the use of depreciation. Business owners hire your kids.

5 Outstanding Tax Strategies For High Income Earners

Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners.

. Read our free guide discover 6 sources of post-retirement income you ought to know. If not youll only. Taking advantage of all of your allowable tax deductions and credits.

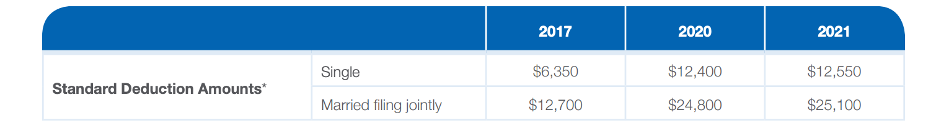

401k Plans On the off chance that you work for an organization that has 401K s exploit it. Grab your 2020 tax return and your most recent pay stub. Here are the 2020 fiscal year numbers.

You make your contributions with pre-tax dollars as the money is deducted from your payroll. Because any investment you make into your IRA excluding a Roth IRA SEP or 401 k is invested before taxes are taken out of your paycheck you reduce your current taxable income and therefore your tax burden for this year. 6 Tax Strategies for High Net Worth Individuals.

Lets start with retirement accounts. When we compare these numbers to what high earners are forking over in 2019 it means youre looking at an extra 59520 in Social Security tax in 2020 if youre self-employed. To be clear I dont mean the additional amount you had to fork over when.

Find a Dedicated Financial Advisor Now. How to Reduce Taxable Income. Thats why its one of the most popular tax reduction strategies.

With a DAF you can make a. July 24 2020 225242. 1 Managing through the annual gift tax exclusion can involve a complex set of tax rules and regulations.

Tax Planning Strategies for High-income Earners. From Simple To Complex Taxes Filing With TurboTax Is Easy. Lets start by reviewing 1040 on your 2020 tax return.

New Look At Your Financial Strategy. However in 2021 The Taxpayer Certainty and Disaster Tax Relief Act of 2020 allows individuals to give 100 of their adjusted gross income to a charity or charities during 2021. If your adjusted gross income AGI on line 11 is above 150000 then you need to at least withhold 110 of your 2020 total tax obligation.

Qualified Charitable Distributions QCD 4. Any more than that and the donation will be carried forward on future tax returns. In 2020 you can.

One of my favorite tax strategies for high income earners is investing in real estate. The importance of tax planning for high-income earners. One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of.

Do Your Investments Align with Your Goals. Convert your conventional SEP or Straightforward IRA to a Roth. If you are 50 or older you are eligible to contribute another 6500 as a catch-up contribution.

One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of current and future year contributions and deduct them all in the current year. Tax deductions are expenses that can be deducted from your taxable income. Sell Inherited Real Estate.

Other than the reality you need a comfortable retirement putting resources into particular kinds of retirement accounts is one the best tax strategies for high income earners. Here are a few options. In case you claim a trade changing your trade structure can be a really successful charge lessening technique for high-income workers.

9 Ways for High Earners to Reduce Taxable Income 2022 1. Ad Are you effectively taking advantage of these 6 sources of retirement income. According to the IRS high-income earners pay almost 70 of the total federal income tax they collect.

You may give up to 15000 30000 if you are married to as many individuals as you wish without paying federal gift tax so long as your total gifts keep you within the lifetime estate and gift tax exemption of 117 million for 2021. Visit The Official Edward Jones Site. These contributions are not part of your gross income and are therefore not subject to income taxes.

Invest in a Tax-Deferred Retirement Savings. The law allows you to give up to 60 of your adjusted gross income and deduct it on one tax return. Typically high-income earners cannot contribute or open a Roth IRA because there is an income restriction.

Well need a couple of things for this. Income splitting and trusts. After age 59-½ in the event that youve met the five-year run the show Roth dispersions are for the most part tax-free.

Employer-based accounts such as 401 k and 403 b accounts allow you. If you earn 139000 or more as an individual or you make 206000 or more as a couple you cannot contribute to a Roth IRA. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account.

Tax planning can be one of the most essential elements of tax-saving strategies for high-income earners. The IRS allow owners of resident occupied real estate to depreciate property over 275 years. Max Out Your Retirement Contributions.

In 2021 the employee pre-tax contribution limit for 401 k and 403 b plans is 19500. A donor-advised fund DAF is an investment account created to support charitable organizations. If your work or assets generate significant income you could pay up to half of your earnings to the US.

These federal tax brackets enable one to understand the need and types of tax-saving strategies for high-income earners. Tax rates vary depending on the trends in the economy. But there is a way around the regulations and it is perfectly legal.

Thats why its one of the most popular tax reduction strategies. The top bracket of.

The 4 Tax Strategies For High Income Earners You Should Bookmark

5 Outstanding Tax Strategies For High Income Earners

How Low Will The S P 500 Go Buffett And Shiller Know Marketwatch Financial Made Goods Investing

Aif Review Icici Prudential Aif Long Short Fund Series 1 Fund Prudential Asset Management

Tax Strategies For High Income Earners Wiser Wealth Management

Big Changes Coming To Social Security Youtube In 2020 Social Security Education And Literacy Social

Real Estate Investment Syndicate Using A Self Directed Real Estate Investing Investing Finance

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Strategies For High Income Earners Wiser Wealth Management

The 4 Tax Strategies For High Income Earners You Should Bookmark

Pin On Blogs Kristian Finfrock

52 Week Money Challenge For Incomes Under 25000 A Year Etsy Money Challenge 52 Week Money Challenge Money Saving Strategies

Tax Strategies For High Income Earners Wiser Wealth Management

Tips For Charitable Giving During The Holidays Charitable Giving Charitable Giving

These Are The Penalties For Filing Taxes Late Filing Taxes Tax Deadline Tax Time

How To Promote Your Loyalty Program Loyalty Program Rewards Program Loyalty

Amazon Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Books